Cent Markets

Your trading success starts here

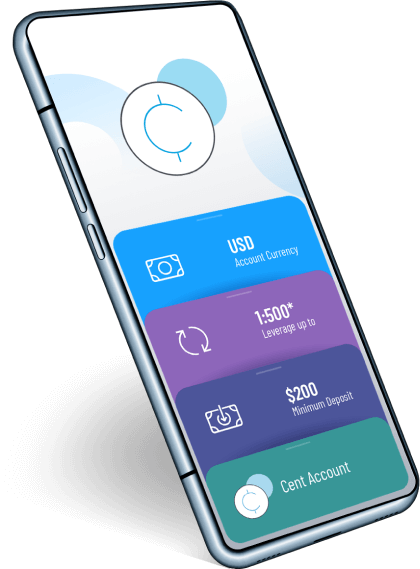

Cent Account

Cent accounts are trading accounts within retail foreign exchange trading with balance measured in cents instead of the US dollars. Trading accounts dealing in cents are handled the same way as any US dollar account with the only difference being the nominal amounts. The Cent account is the perfect choice for those who want to start real trading with small investments. This account type allows you to trade in cents with smaller lots, making it low-risk.

Advantage and disadvantage

Retail brokerage companies say that cent accounts can be useful to Forex beginners since they allow trading with real money without risking too much. Cent account balance is indicated in cents, which helps beginners get accustomed to seeing sums of many thousands on their accounts. Cent account is a kind of a transitional stage between demo and dollar accounts being a first step into a real trading, an opportunity to decrease the minimum available position size to 0.0001 of a standard lot. There is no minimum or maximum deposit and no other specific requirements to open a cent account. The disadvantage of cent accounts is that the majority of Forex brokers offering such a service limit the maximum account and position size to keep the usage down to a minimum. Also, the cent accounts are associated with higher quote spreads to compensate brokers.

Copy Trading

One of popular direction where Forex Cent accounts are used is Copy trading. Copy trading is a branch of social trading, where one trader's positions are copied by another trader's account when they are opened or closed. This can be either automatic or manual – and it's up to an individual to decide how they would like to approach copy trading. Using Cent accounts for Copy trading can be more profitable while investor will deversificy their portfolio by investing in few traders. That will lower risk, as between that traders will be manual traders, bots(algo traders) and most of them will use differen strategis an money managment tools.

The concept of "following" or "subscribing" to other traders has taken on a new life in recent years, especially with the explosive growth of cryptocurrency markets and advancements in AI-driven trading bots. Social trading platforms have seen a surge in popularity, allowing everyday investors to tap into the expertise of seasoned traders across a variety of markets. The rise of cryptocurrencies has played a significant role in this renewed interest. With the crypto boom, traders now have the opportunity to diversify their portfolios across different markets and liquidity providers, following strategies that were once out of reach for the average investor. AI-powered bots have further revolutionized the scene, offering sophisticated, automated trading strategies that operate around the clock, responding to market fluctuations in real-time. Social trading platforms are at the heart of this movement, providing a space where users can connect, share insights, and subscribe to the strategies of top-performing traders. These platforms make it easier than ever for individuals to enter complex markets, leveraging the collective knowledge and expertise of a global trading community. As a result, the practice of following other traders has become not just a trend, but a powerful tool for those looking to navigate the fast-paced and often unpredictable world of modern markets. This combination of social trading, AI, and diverse market access is reshaping the way people think about investing, making sophisticated trading strategies accessible to everyone, regardless of experience level.

Trade for success, not for money. Let profits run and cut losses. After 3 losers take a break.

— Lewis Borsellino